Blog Layout

Illinois' Adult-Use Cannabis Business Timelines, Challenges, and Opportunities

Last Updated on Sep 26, 2019

Illinois is poised for a robust adult-use market with a state population of 12.7 million and tourism spending at $16 billion in 2018. As sales climb to a projected $2 billion annually

within a few years of the program’s launch, potential business owners have much to do to meet upcoming deadlines and quickly get their businesses operational for early 2020 sales. In California, we have witnessed how even the most robust forecasts can prove unreliable if programs cannot compete with the lower pricing of the black market. This could also be a challenge for Illinois with the state planning to tax purchases

of cannabis products by 10% to 25% depending on the product type and THC potency. Additionally, municipalities and counties will be able to levy added local sales taxes. The law also imposes a 7% gross receipts tax on the sale of marijuana from cultivators to dispensaries, which will most likely be an expense passed onto consumers.

Another challenge that Illinois cannabis businesses are facing is navigating municipal bans on recreational cannabis. Under state law, local governments have the option to prohibit adult-use cannabis sales, putting previously established medical operations in these areas at a disadvantage. Despite being given adult-use licensing priority over new businesses, medical operations will need to have a compliant location to qualify for state licensure. Securing compliant and strategically-located real estate is one of the biggest challenges for any cannabis business, and Illinois proves to be no exception to this. If businesses can enter the Illinois adult-use market swiftly and compliantly, however, they will surely be rewarded in the years to come.

60% of Chicago Voters Support Legalizing Cannabis

While challenges abound for the 11th state to legalize adult-use cannabis, there are also plenty of opportunities. According to a poll conducted by Global Strategy Group on behalf of Think Big Illinois, Six out of ten voters support legalizing recreational marijuana, taxing it, and regulating it (60% support vs. 35% oppose). Most notably, the city of Chicago has 60% support, Cook County Suburbs outside Chicago has 68% support, and Collar Counties has 60% support. With 76,939

medical cannabis patients in the state, those approvals are encouraging to see and will undoubtedly yield a thriving customer base for operations serving both patients and adult-use consumers. Add to the fact that the qualifying conditions under the Compassionate Use of Medical Cannabis Program were expanded in August 2019 and the state could see a healthy rise in medical demand despite the usual slow-down or even decline in patients and sales when adult-use markets come online. Medical patients will also be prioritized when it comes to dividing up the state's limited supply between medical and adult-use markets. Additionally, medical patients will only be subject to a 1% sales tax as opposed to the 10% to 25% tax for adult-use consumers.

Adult Use Program Highlights

- Non-residents are limited to half of what state residents can possess, but the state will most likely benefit from tourist purchases especially in Chicago.

- Applicants that fall under social equity provisions receive additional points, potential financial resources, and support such as low-interest loans, grants, training assistance, and mentoring.

- Only Medical Marijuana patients may grow cannabis in their homes starting January 1, 2020.

- Vertical integration is allowed.

- Existing cultivation centers will be tasked with producing enough product for both medical and recreational markets until new entrant licenses are distributed in May and July 2020.

- Counties may enact a purchaser excise tax up to 0.5% in incorporated areas in increments of 0.25%

- Municipalities may enact a purchaser excise tax up to 3% in increments of 0.25%

- Unincorporated areas may adopt a purchaser excise tax up to 3.5% in increments of 0.25%

- Here is a summary of the state of the adult-use program.

Established Medical Cultivation Centers and Dispensaries Have Been Given Adult-Use Licensing Priority Over New Entrants to the Market.

- 60 days after the Illinois Cannabis Regulation & Tax Act was signed, existing medical dispensaries and cultivation centers were eligible to apply for an adult-use license.

- Established medical dispensing organizations may apply for a second license at a new location under the same parameters.

- Operations in Naperville, Mundelein, Joliet, Effingham, and Canton have received adult-use licenses by the state. Only Joliet and Canton’s local governments have opted-in for adult-use sales and recently, Naperville voted to ban adult-use sales, putting medical cannabis businesses in the city in a tough spot.

Costs

Dispensary License 1:

- Non-refundable permit fee: $30,000

- Cannabis business development fund fee: 3% of total sales between July 1, 2018, to July 1, 2019, or $100,000, whichever is less

Dispensary License 2:

- Non-refundable permit fee: 30,000

- Cannabis business development fund fee: $200,000

Cultivation Organizations:

- Non-refundable permit fee: $100,000

- Cannabis business development fund fee: 5% of total sales between July 1, 2018, to July 1, 2019, or $500,000, whichever is less

New Illinois Adult-Use Cannabis Entrants

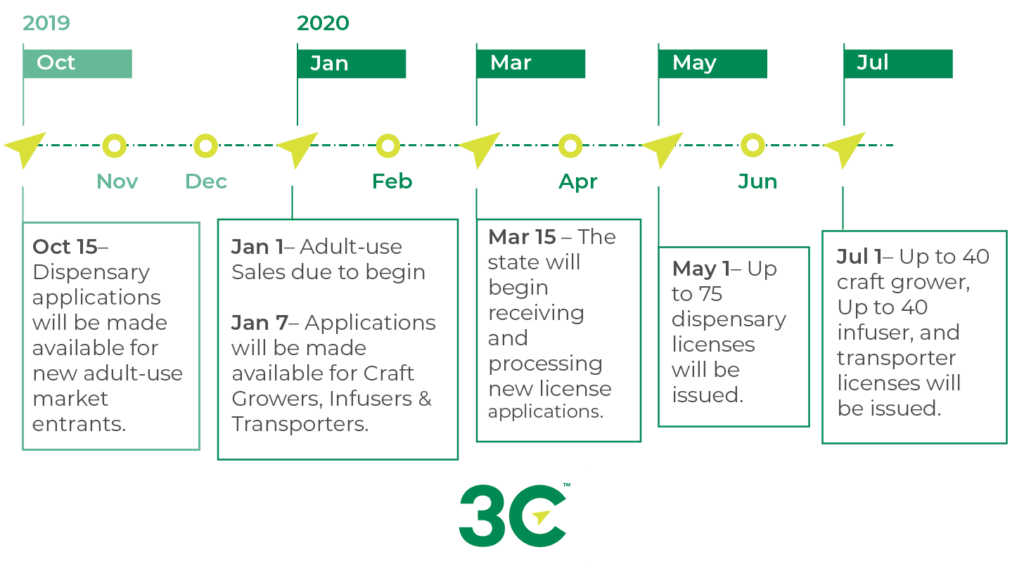

The state will begin receiving and processing all new entrant license applications on March 15, 2020

Dispensing Organizations:

- October 15, 2019 – Dispensary license applications will be made available for new adult-use entrants to the market

- May 1, 2020 – Up to 75 dispensary licenses will be issued for new adult-use entrants

- Costs: $5,000 - Non-refundable application fee, $30,000 - License fee

- Wave 2: December 21, 2021– Up to 110 licenses for new dispensing organizations

Craft Growers:

- A new category of cultivator (starts at 5000 sq. ft. and can be granted permission of up to 14000 sq. ft. for flowering canopy)

- January 7, 2020 – Applications available

- July 1, 2020– Up to 40 craft grower licenses will be issued

- Costs: $5,000 - Non-refundable application fee, $40,000 - License fee

- Wave 2: December 21, 2021– Awards up to 60 licenses for craft growers

Processors/ Infusers:

- January 7, 2020 – Applications will be available

- July 1, 2020– Up to 40 infuser licenses will be issued

- Costs: $5,000 - Non-refundable application fee, $40,000 - License fee

- Wave 2: December 21, 2021– Awards up to 60 licenses for processors

Transporters:

- January 7, 2020 – Applications will be available

- July 1, 2020 – licenses will be issued (unlimited)

- Costs: $5,000 - Non-refundable application fee, $10,000 - License fee

- Wave 2: December 21, 2021– Awards licenses for transporters

Regulations & Laws

The Illinois Department of Financial and Professional Regulation Oversees:

- Dispensaries

- Cultivation centers

- Craft growers

- Transporters

- Processors/ Infusers

Laws:

- HB1438: Cannabis Regulation & Tax Act

- Date of Initial Legalization: June 2019

Recommended Articles

C O N N E C T W I T H U S

A.

1001 BANNOCK STREET, SUITE 419

DENVER, CO 80204

C O M P A N Y

R E S O U R C E S

S E R V I C E S

©2024 3C Consulting, LLC™. All Rights Reserved. Terms of Use | Privacy Policy

D I S C L A I M E R

3C does not purport to and does not, in any fashion, provide tax, accounting, actuarial, record-keeping, legal, broker/dealer or any related services. Investments involve inherent risks. There is no guarantee that provided strategies, tactics and methods will produce a return. 3C will never share your email address and ensure that all information is kept completely confidential.

No material on this site is intended to be a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or qualified health provider with any questions you may have regarding a medical condition and before undertaking a new health care regimen. Never disregard professional medical advice or delay in seeking it because of something you have read on this Website.